Difference Between Whole and Term Life Insurance | 8651

Introduction to Life Insurance

Life insurance is a crucial financial product designed to provide individuals and their families with a safety net in the event of an untimely death. At its core, life insurance serves as a contract between the policyholder and the insurer, wherein the latter agrees to pay a predetermined sum of money to designated beneficiaries upon the death of the insured. This financial support can be instrumental in covering outstanding debts, ongoing living expenses, or education costs, thus alleviating the burden on surviving family members during a challenging time.

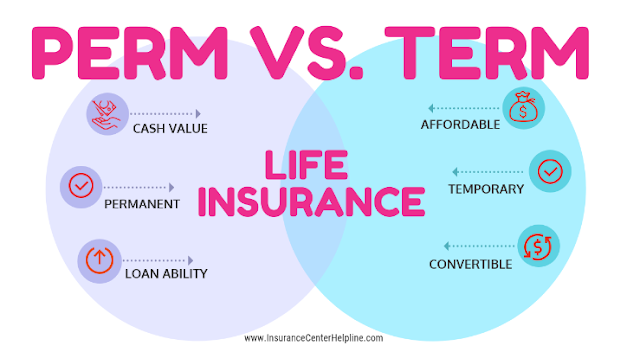

The importance of life insurance cannot be overstated, as it plays a vital role in ensuring financial stability for loved ones when the unexpected occurs. As individuals plan for their futures, establishing an appropriate life insurance policy is a key consideration, enabling them to secure their family’s financial well-being even in their absence. Among the various types of life insurance available, two primary categories stand out: whole life insurance and term life insurance. Understanding the life insurance difference between whole and term is essential for policyholders to make informed decisions that align with their financial goals and family needs.

Whole life insurance provides coverage for the lifetime of the insured, allowing for lifelong protection along with a cash value component that accumulates over time. In contrast, term life insurance extends coverage for a specified period, offering an affordable option for temporary protection without the cash value benefits. By examining these two types of policies, individuals can better identify their specific requirements and preferences, setting the stage for a more detailed comparison in the following sections. Ultimately, recognizing the life insurance difference between whole and term is invaluable for consumers aiming to optimize their financial planning strategies.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that offers coverage for a predetermined period, typically ranging from 10 to 30 years. During this term, if the insured individual passes away, a death benefit is paid out to the beneficiary. One of the primary attractions of term life insurance is its straightforward nature; it focuses solely on providing financial protection during the specified term without accumulating cash value, which distinguishes it from whole life insurance policies.

One of the most significant advantages of term life insurance is its cost-effectiveness. Premiums for term policies are often significantly lower than those for whole life policies, making it an appealing option for individuals seeking affordable protection. This financial savings can be particularly beneficial for young families or individuals looking to ensure that their loved ones will be supported in the event of an untimely death. Moreover, the simplicity of term life insurance makes it easier for policyholders to understand what they are purchasing, eliminating the complexity that sometimes accompanies life insurance products with investment components.

Term life insurance is ideal for specific situations. For instance, it is a suitable choice for individuals who have temporary financial obligations, such as a mortgage or children's education costs, which may diminish over time. By aligning the insurance coverage with the duration of these financial responsibilities, policyholders can secure peace of mind while avoiding unnecessary expenditures. Furthermore, term life insurance can serve as a safety net during crucial life stages, allowing beneficiaries to maintain their standard of living without the burden of financial strain. The defined term structure can be advantageous for people who anticipate life changes that may affect their need for life insurance coverage.

What is Whole Life Insurance?

Whole life insurance is a form of permanent life insurance that remains effective throughout the policyholder's lifetime, provided that the premiums are consistently paid. Unlike term life insurance, which offers coverage for a specific period, whole life insurance guarantees a death benefit for the insured's entire life. This feature makes whole life an attractive option for individuals seeking long-term financial security for their beneficiaries.

One of the distinguishing aspects of whole life insurance is its cash value accumulation. As the policyholder pays premiums over the years, a portion of these payments is allocated to a cash value account. This account grows at a guaranteed rate and can serve various financial purposes. For instance, the policyholder may borrow against this cash value for unexpected expenses, or even withdraw funds for significant life events such as education or home purchases. The ability to accumulate cash value provides an added layer of financial planning that is not available with term policies.

However, this additional benefit comes with a cost. Whole life insurance premiums are typically higher than those associated with term insurance. This is due to the policy's lifelong coverage and the cash value component that builds over time. While these higher premium costs may be a deterrent for some consumers, many view them as a worthwhile investment for the peace of mind that comes with permanent coverage and cash value growth.

Overall, understanding the differences between whole life and term life insurance is crucial for individuals making informed decisions about their life insurance needs. Whole life insurance offers permanence and a cash accumulation feature that can significantly enhance an individual's financial portfolio, despite its higher cost compared to term options.

Key Differences Between Whole and Term Life Insurance

When evaluating the life insurance difference between whole and term, it is essential to consider several key aspects that influence the suitability of each policy for individual needs. One significant distinction lies in the coverage duration. Term life insurance offers protection for a specified period, typically ranging from 10 to 30 years. In contrast, whole life insurance provides lifelong coverage, as long as the premiums are maintained. This fundamental difference is pivotal in determining which policy is more compatible with an individual's long-term financial goals.

Another critical aspect is the cost associated with premiums. Generally, term life policies have lower premiums compared to whole life policies. This difference arises from the fact that whole life insurance incorporates a savings component that contributes to cash value accumulation over time. While the lower premium costs of term insurance may be appealing, it is crucial for potential policyholders to weigh this against the potential benefits of building cash value in a whole life policy.

Cash value accumulation is a defining feature of whole life insurance that sets it apart from term life. Whole life policyholders can access and borrow against the cash value, which grows at a guaranteed rate. This feature can serve as an important asset for financial planning, providing a source of funds for emergencies or significant expenditures. However, term life insurance does not offer this benefit; once the term expires, there is no cash accumulation, and the policyholder receives no return on premiums paid.

In assessing the lifestyle needs and financial objectives, the suitability of each policy type varies. Term life insurance may be more appropriate for those who seek affordable coverage for a specific duration—such as parents wanting to secure their children's education—while whole life insurance may appeal to those desiring lifelong protection and an investment avenue. Understanding these key differences between whole and term life insurance is crucial in making informed decisions about one's life insurance needs.

Cost Comparison: Whole vs. Term

When evaluating life insurance options, it's essential to consider the cost implications of whole and term life insurance. One of the most significant differences between these two types of policies is the initial premium costs. Generally, term life insurance tends to have lower initial costs compared to whole life insurance. This affordability makes term policies particularly attractive for younger individuals or families who are looking for budget-friendly coverage during critical financial periods, such as raising children or paying off mortgages.

Term life insurance typically offers coverage for a specified period, often ranging from 10 to 30 years. As a result, the premiums for these plans are significantly lower than those of whole life insurance, which provides lifelong coverage and a cash value component. While the lower costs of term policies can be appealing, it’s crucial to consider the long-term implications of each option. Once the term expires, policyholders may need to renew their coverage, which could lead to increased premiums, especially if they are older or face health issues at the time of renewal.

In contrast, whole life insurance presents a more substantial initial investment due to its lifelong coverage and cash surrender value. This policy not only provides a death benefit but also accumulates cash value over time, which can be accessed or borrowed against. Although the higher premiums of whole life insurance may deter some consumers, it is essential to evaluate these costs within the context of the long-term benefits and financial security it can offer.

Ultimately, when comparing the cost of whole vs. term life insurance, consumers should carefully assess their financial needs, future goals, and the potential long-term value of their investment. Understanding these differences between the two types of policies will facilitate more informed decisions regarding life insurance coverage.

Who Should Consider Term Life Insurance?

Term life insurance is often a suitable option for a variety of individuals and families, particularly those seeking temporary or affordable coverage. One key demographic that may benefit from term life insurance is young families. Typically, these families may have children who are still dependent on their parents for financial support. Term life insurance helps ensure that in the event of an untimely death, the dependents would receive financial resources to cover daily living expenses, educational costs, and debts during the crucial years of raising children.

Additionally, individuals with temporary financial obligations should consider this type of coverage. For instance, people who are in the process of paying off a mortgage or other significant debts might find term life insurance particularly valuable. The policy can provide reassurance, knowing that if something were to happen, their loved ones would not be burdened with outstanding financial responsibilities. This targeted approach allows policyholders to align coverage duration with specific financial obligations, making term life insurance an efficient financial tool.

Moreover, term life insurance is appealing to those looking for an affordable solution. Compared to whole life insurance, term policies generally come with lower premiums, making them an attractive choice for budget-conscious individuals. This aspect can be especially relevant for younger adults or new parents who may have other financial priorities, such as saving for a home or education expenses. With its cost-effective nature, term life insurance enables individuals to obtain adequate coverage during pivotal life stages without the financial strain.

In conclusion, term life insurance can be particularly beneficial for young families, individuals managing temporary financial obligations, and those prioritizing budget-friendly options. These diverse scenarios highlight the flexibility and relevance of term life insurance for a wide array of risk profiles.

Who Should Consider Whole Life Insurance?

Whole life insurance serves as a suitable option for individuals who have long-term financial goals and those who seek a stable, lifetime insurance solution. Unlike term life insurance, which provides coverage for a specified period, whole life insurance guarantees coverage for the insured's entire life. This inherent aspect makes it particularly appealing for policyholders who desire security in their financial planning.

A significant advantage of whole life insurance is the ability to accumulate cash value over time. This cash value growth can be particularly beneficial for individuals looking to build wealth while also securing a death benefit for their beneficiaries. The predictable structure of whole life insurance premiums allows policyholders to prepare more effectively for future financial commitments, such as funding education or providing an inheritance.

Moreover, individuals who prioritize psychological peace of mind should consider whole life insurance. The assurance of lifelong coverage and the certainty that loved ones will receive a financial safety net upon the policyholder’s passing can alleviate anxiety regarding future uncertainties. This is especially pertinent for individuals overseeing families or those with dependents who depend on their financial support.

Furthermore, business owners and high-net-worth individuals may find whole life insurance attractive as a means to facilitate estate planning. The death benefit can be used to cover taxes or settle debts, thereby preserving wealth for future generations. When assessing the considerations of life insurance difference between whole and term, those in need of long-lasting financial strategies might lean more towards whole life as a comprehensive solution.

In conclusion, whole life insurance is ideally suited for individuals focused on long-term financial stability, wish to grow wealth, or seek peace of mind through guaranteed lifelong coverage. Understanding personal financial objectives is crucial when making this significant decision in life insurance planning.

Tax Implications of Life Insurance Policies

Life insurance policies are often considered a means of financial security for families and dependents, but they also entail various tax implications that policyholders should understand. One of the most significant benefits of life insurance is that the death benefits provided to beneficiaries are generally received tax-free. This feature allows families to manage the financial burden of losing a loved one without the additional concern of tax liabilities on the received funds. Such tax treatment makes life insurance a strategic component in estate planning.

Whole life insurance, in particular, can accumulate cash value over time, which also benefits from tax advantages. The growth of this cash value is tax-deferred, meaning policyholders will not incur taxes on any gains as long as the funds remain within the policy. This tax-deferred growth is a notable aspect of the life insurance difference between whole and term policies, as term life insurance does not offer this feature, focusing solely on providing death benefits rather than accumulating cash value.

However, it is essential for policyholders to be aware of the tax implications associated with withdrawing or borrowing against the cash value of whole life insurance. If a policyholder takes a withdrawal, the amount exceeding the total premiums paid may be subject to income tax. Similarly, if the policy is surrendered, any cash value amount received could also trigger tax liabilities. Borrowing against a policy, while a viable option for accessing cash, may affect the policy's death benefit and could result in tax implications if the policy lapses. Therefore, while life insurance can offer considerable tax benefits, understanding the details is crucial for informed financial planning.

Making the Right Choice for Your Needs

Life insurance is a crucial part of financial planning, and selecting between whole and term life insurance can greatly impact your family's financial security. To make an informed decision, one must first assess their individual financial situation and evaluate their family's needs. Whole life insurance offers lifelong coverage with a cash value component, while term life insurance provides coverage for a specified period at a lower cost. Therefore, understanding the life insurance difference between whole and term is vital in determining which type aligns best with your circumstances.

In determining your needs, consider factors such as your current financial obligations, future expenses such as children's education, and your overall estate planning goals. For instance, if you have dependents who rely on your income, a term policy might be suitable for providing coverage until your dependents achieve financial independence. Conversely, if you desire a death benefit that lasts your entire lifetime and can be part of your estate, whole life insurance may be preferable.

Another aspect to examine is your long-term financial objectives. If you're looking to build cash value while ensuring a lifelong policy, whole life insurance could meet these criteria. On the other hand, for temporary needs that align with major life events, term life insurance may serve as an effective solution. It is essential to project how insurance fits into your broader financial strategy over time.

Finally, consulting with a qualified financial advisor can help navigate these decisions. An advisor can provide tailored insights based on your specific situation, helping you weigh the pros and cons of each option. By carefully evaluating your financial environment and engaging professional advice, you can confidently choose the appropriate life insurance coverage that best suits your family's needs and long-term financial goals.

Post a Comment for "Difference Between Whole and Term Life Insurance | 8651"